Bóveda de tarjetas: Sencillo y seguro

Transfiera criptomonedas fácilmente, gestione sus NFT y apueste o intercambie fichas, todo con un solo toque.

-

1.000.000 de usuarios

-

$12B Protegido

-

Más de 10.000 fichas

-

7 años seguro

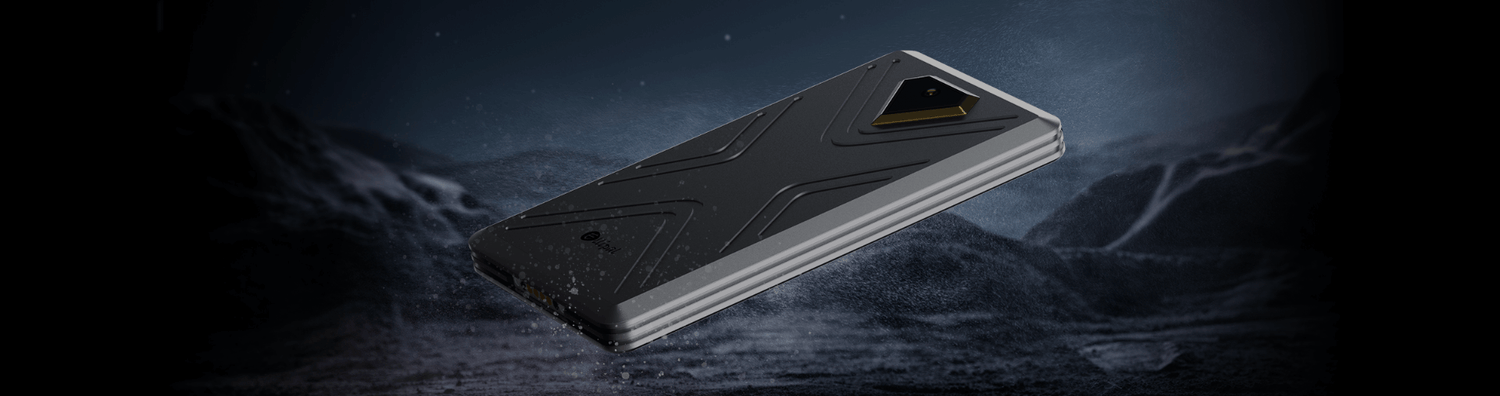

La primera cartera refrigerada del mundo con tapa de aire

Sin Bluetooth, Wi-Fi, USB, NFC ni ninguna red. Tus claves privadas permanecen 100% offline en todo momento.

Se acabó firmar a ciegas. La pantalla de 4,0 pulgadas muestra exactamente los detalles de lo que estás firmando.

Súper fácil de usar: Cripto, simplificado

3 pasos hacia la libertad

Configura tu Bitcoin y otros monederos en minutos. No requiere doctorado.

-

Crear

Su cuenta

-

Copia de seguridad

Su frase semilla

-

Completar

Listo para empezar

Gestión integral de activos

-

You can buy or sell crypto on the ELLIPAL App. Choose from a range of service providers – Simplex, MoonPay – and select the option that works best for you. Your crypto will land safely in your ELLIPAL wallet.

-

Swapping allows you to explore different crypto assets, protect your crypto from volatility, and diversify your portfolio. It is possible to swap through the ELLIPAL app without using fiat currencies.

-

Put your crypto to work and get rewards. You can start staking coins through the ELLIPAL app. Track your rewards in the Earn section and discover staking opportunities across chains.

-

ELLIPAL supports MetaMask and WalletConnect for connecting to 200+ dApps. Explore DeFi and grow your assets.

* Crypto transaction services are provided by third-party providers. ELLIPAL provides no advice or recommendations on use of these third-party services.

ELLIPAL Admite más de 10.000 monedas y fichas

ERC20, BEP20, TRC20, SOL Ecosystem y más...

Cero trucos, cero dudas

Su tranquilidad no tiene precio.

Voz de la Comunidad: Seguridad real, libertad real

Consenso 2025 - Estaremos allí

Estamos participando activamente en esta reunión mundial de innovadores de cripto, blockchain y Web3.

Conoce al equipo ELLIPAL, explora nuestras últimas innovaciones y experimenta de primera mano el futuro del almacenamiento seguro de criptomonedas.

¡Nos vemos en Toronto!

Respuestas a preguntas frecuentes

¿Qué es una cartera fría?

Dispositivo de hardware utilizado para almacenar claves privadas de criptomoneda de forma segura. Funciona completamente offline, protegiendo tus criptoactivos de ataques online.

¿Por qué necesito una cartera fría?

El uso de un monedero frío proporciona el más alto nivel de seguridad, ya que no está conectado a Internet

eliminando el riesgo de ataques en línea. Es ideal para aquellos que quieren almacenar grandes cantidades de criptomoneda

a largo plazo.

¿Qué diferencia a ELLlPAL de otros monederos fríos?

El monedero en frío ELLIPAL se distingue por su naturaleza 100% offline air-gapped a la vez que soporta cómodas transacciones, swapping y staking.

Utiliza tecnología anti-sabotaje y avanzadas medidas de seguridad física para garantizar que sus activos están protegidos de forma segura.

¿Qué pasa si pierdo mi cartera fría ELLIPAL?

Si ya no puedes acceder a tu monedero frío ELLIPAL, puedes recuperar tus criptomonedas con mnemónicos y contraseñas en cualquier momento en otros monederos basados en el Protocolo BIP-39.

Recuperarás el acceso a todas tus cuentas, saldo y datos de transacciones.